Customer Spotlight: Hitachi Rail

To bring a hybrid rail solution to market, Hitachi needed an electrification partner to help them retrofit their existing trains. As an experienced supplier with a deep understanding of cell chemistry and how to integrate battery systems into vehicles, Turntide was the perfect choice.

Customer Spotlight: Innovative Franchise Owner

$25,000 of energy savings in 5 locations

- Reduces operating costs and improves overall profitability

- HVAC accounts for 28% of energy consumption in restaurants

- Lowers impact on environment

- Franchise owner demonstrates ESG impact of Turntide, helping accelerate corporate ESG goals

Watch more case study videos:

Turntide Transformational Climate Impact

558,837,506

Kwh of energy saved as of 2023

Has the same climate impact as:

472,283

Acres of new forest planted

38,903,571

Fewer gallons of gas used

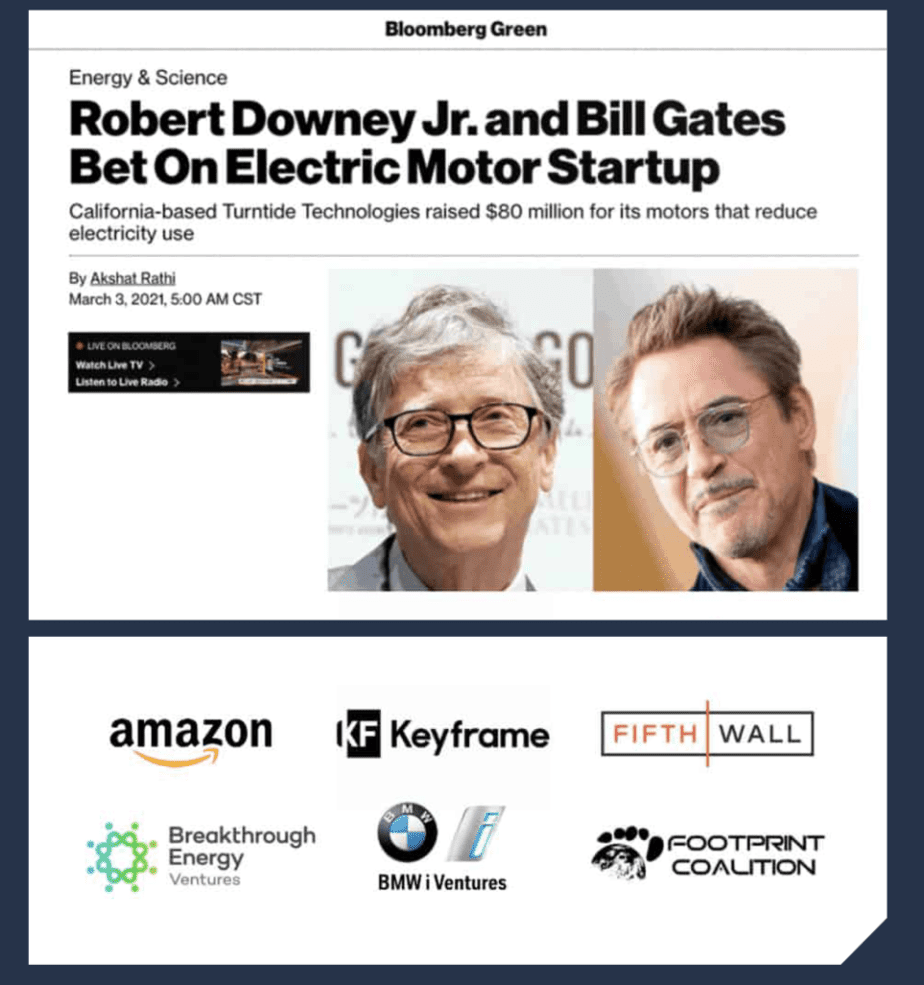

Award-winning technology

& world-class investors

What's New

Partner With Us and Turn the Tide

Join us in optimizing how the world consumes energy. Whether you are an ESCO, OEM, utility, or reseller, our platform is creating an ecosystem with new opportunities for companies throughout the sustainability industry.

Take the Next Step

Talk to our team to see how we can help you save energy and boost your bottom line.

Schedule Consult